See All Annuities

Avoid Market Risk

Lifetime Income

What Annuity Is Right For Me?

Do you want growth or lifetime income?

Access all top annuities, no matter what I get paid!

100% protection from market downturns

Work with an annuity specialist who's actually in YOUR corner.

Simplified Annuity Guidance

Personalized Retirement Strategies

I’ll work with you before, during, and after you purchase your annuity to ensure you get the perfect fit for your situation.

See All Lifetime Income

Annuities

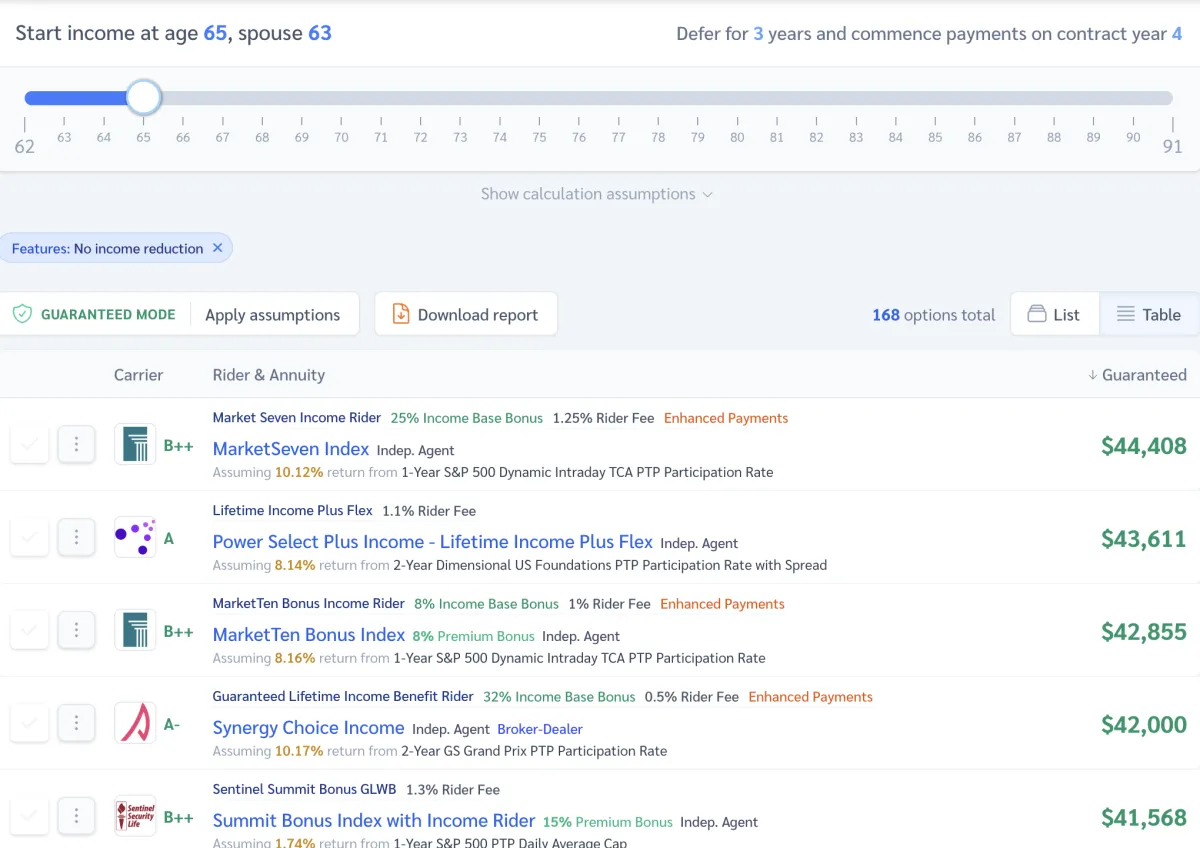

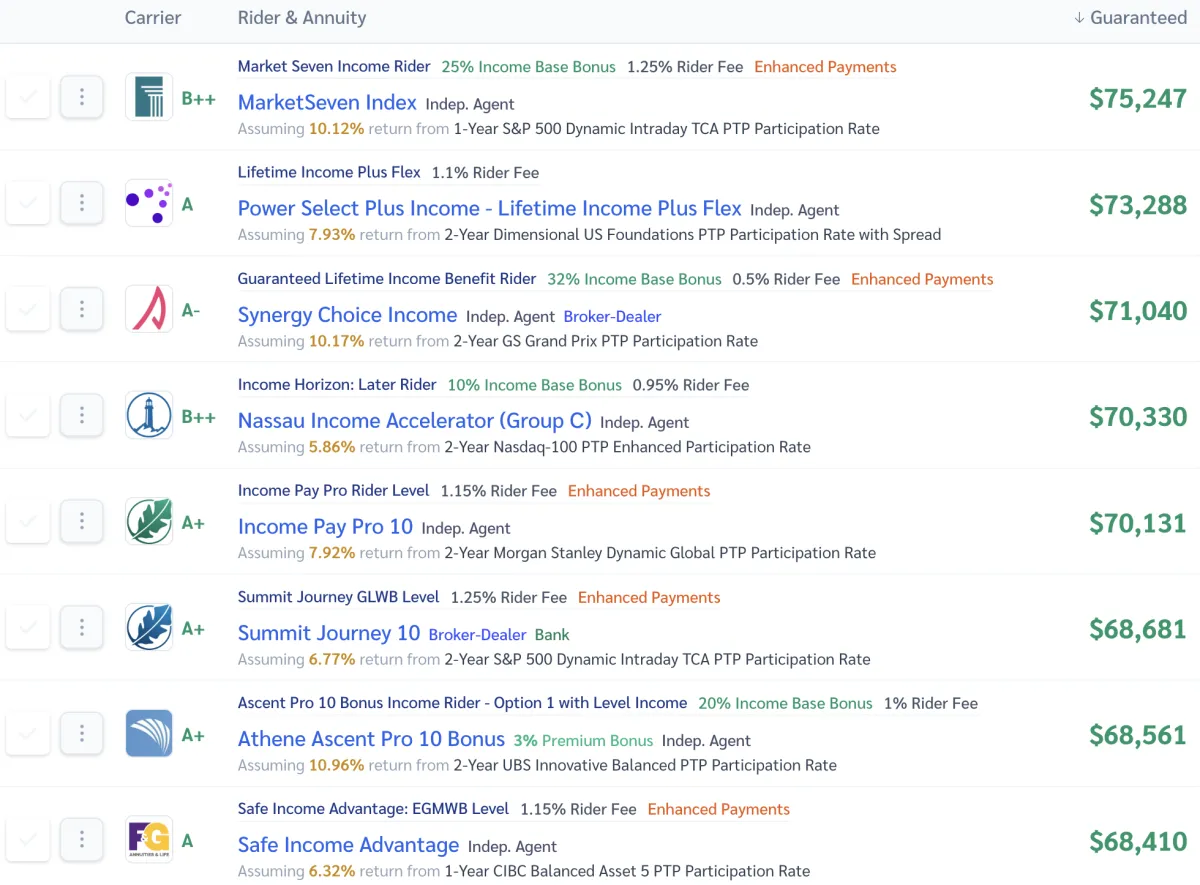

I work tirelessly to identify annuities that provide the absolute highest income in retirement, even if I'm paid less...

Don't Be Sold the Wrong Annuity!

Instead of being steered into the product that makes the advisor the most, finally get access to all of the annuities on the planet.

Who I’ve Helped

Don’t take my word for it

My wife and I were looking for retirement planning guidance and were fortunate to learn about John from his YouTube videos. We are very happy with the service and expertise he provided. John is a great listener, patient, thorough and extremely knowledgeable. We look forward to working with him throughout our retirement and we highly recommend him.

Lance Treat

When my husband and I were looking at getting an annuity plan we came across John and decided to request his free book and was so glad that we did. John has been so helpful in answering all our questions and meeting with us multiple times to help us decide which company to go with. We have been very impressed with his knowledge, and always having our needs at the forefront We highly recommend John for all your Annuity questions. He will treat you like family and recommend the best policy for you.

Lisa Burrows

We recently worked with John to guide us through an annuity purchase. John is extremely responsive, thorough and professional. He showed us various options but we never felt he was pushing us to one product or another. Going in, we had an idea of what product we wanted, but we also had questions based on some of our own research, but asked him for his thoughts based on his expertise. My highest recommendations.

Bill (and Corinne) Bonneau

How It Works

Why Work With Me?

Providing tax-free wealth and retirement consulting services to his clients since 2002. John has been able to help many people create retirement income they can’t outlive, pass on estates to their loved ones, and build wealth safely.

John knows the importance of helping families protect against financial downturns and build wealth. He has recently been published in numerous publications with millions of readers worldwide such as Blogher, NuWire Investor, MenProvement, YFS Magazine, Annuity.com and others

Host of GRG Podcast

International Best-Selling Author

Certified Financial Fiduciary

Host of The Guaranteed Retirement Guy show

Owner, Founder of Annuity.com, Inc

FAQ

Do annuities carry hidden fees?

Depending on the type of annuity you purchase (immediate, fixed or fixed indexed), your policy could have no charges. But some annuities do have surrender charges on withdrawals taken during your surrender charge period. Other plans may offer options to take a portion of their account value penalty-free.

Many fixed indexed annuities have additional fees with optional riders for guaranteed lifetime income, a specific growth rate, wealth transfer and even access to funds in the event of specific health needs. These features provide more benefits and can add more value to your policy.

Are annuities overly complicated?

Annuities with a guaranteed lifetime withdraw benefit work like Social Security or a pension. They can guarantee you a lifetime stream of income, subject to certain conditions and assuming no excess withdrawals are taken.

Annuities are tied to the stock market, so can’t I lose money?

With a fixed indexed annuity, your money is not invested directly in the market. It’s linked to an index, so your account value will never be credited less than zero if that index decreases. Linking to an index provides the potential to earn interest, and your account value can grow if the index increases.

If I buy an annuity, will I have access to my money?

A majority of annuity contracts permit you to make a one-time withdrawal per year without being charged a withdrawal fee. This amount is typically limited to 10-15% of the current accumulated value of the investment. However, they comply with income tax laws for all withdrawals, including the free once-a-year withdrawal.

Another way that you can get money from your annuity is through what is called the systematic withdrawal plan. A systematic withdrawal plan is what allows you to receive a guaranteed flow of income every month, quarter, semi-annual, or annual basis.

The systematic withdrawal system differs from annuitization because it’s not a permanent decision. This system gives you the option to start or stop these payments whenever you desire. These payments give you flexibility without losing control of your money or the taxes that come with the transactions.

With systemic withdrawals, the earnings are taxed first, so your earnings have been exhausted, allowing the tax-free return on principal to remain.

When I die, does the insurance company keeps my remaining money?

As long as the account balance hasn't yet been used up, your full account value will be passed to your named beneficiaries. No surrender charges will be applied and your beneficiaries can usually avoid probate.

Do I have to pay you the financial professional out of my own pocket in order to buy an annuity?

You are not required to pay the financial professional directly in order to buy an annuity. Your full premium is available to potentially earn interest from the annuity’s effective date. Annuity products are only offered through financial professionals and licensed insurance producers, who are compensated through commissions which are not deducted from the premium paid for the policy.

Can I Purchase an Annuity with My 401(K) Distribution?

More and more 401(K) plans are adding annuities as options now that the 2019 SECURE Act has passed Congress. However, the annuity options that your 401(K) offers may not reflect the options in the commercial marketplace or may have a structure that doesn’t work for you. 401(K) plan managers often aren’t skilled at helping you select an annuity that’s right for you.

Shopping the market means you can spot the best rates rather than settling for one. Only once you learn more about your available policies can you make an informed decision about the best choice.

© 2026 John Stevenson. All Rights Reserved

Privacy Policy | Terms & Conditions